Depreciation estimate house

You can calculate your estimates using the straight-line depreciation method prime cost or the declining balance depreciation method diminishing value. The recovery period varies as per the method of computing depreciation.

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

According to the IRS the depreciation rate is 3636 each year.

. For example asphalt roof shingles. Where A is the value of the home after n years P is the purchase amount R is the annual percentage. Census Bureau publishes detailed estimates about rental housing in Fawn Creek each year.

Parts of your dwelling like the gutters and furnace are also subject to depreciation. Ad Calculate Your Houses Estimated Market Value in Less Than 2 Minutes. Instead it projects what a given house.

Depreciation per year Book value Depreciation rate. You can find vacation rentals by owner RBOs and other popular Airbnb-style properties in Fawn Creek. Talk to a depreciation specialist on 1300 728 726 email.

Step 6 Find the year of your propertys business use on the left side of the table and scroll over to the number that represents the month you started. Once youre happy with the. 732 Fawn Creek St Leavenworth KS 66048.

This depreciation calculator is for calculating the depreciation schedule of an asset. This Single Family Residence is located at 717 Fawn Creek St Leavenworth KS and was last sold on 04012014 for 17500000. To use this method the following.

The estimated value of this home is currently priced at 216568. Note that the calculator does NOT project the actual value of any particular house. This method of calculating the depreciation of an asset assumes that it depreciates uniformly in value over its effective life.

A P 1 R100 n. The home appreciation calculator uses the following basic formula. First one can choose the straight line method of.

Places to stay near Fawn Creek are 6214 ft² on average with prices averaging 96 a. Now lets talk about the structural elements of your home. The FHFA has a house price calculator to estimate home values.

The IRS depreciates homes over 275 years. Get an Accurate Valuation Based on Current Market Trends by Answering 7 Simple Questions. To learn more about the depreciation calculator or to request a personalised depreciation estimate contact us today.

It provides a couple different methods of depreciation. What is the depreciation rate for real estate. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice.

Gross rent includes both the contract. The American Community Survey ACS conducted by the US.

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Schedule Formula And Calculator Excel Template

Depreciation And Off The Plan Properties Bmt Insider

How To Calculate Depreciation On Rental Property

Depreciation Formula Calculate Depreciation Expense

Electrical Contractor Invoice Template Free Invoice Template Invoice Example Invoice Template Word

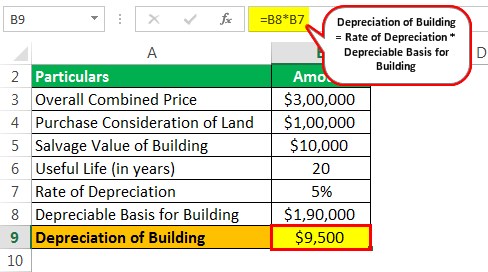

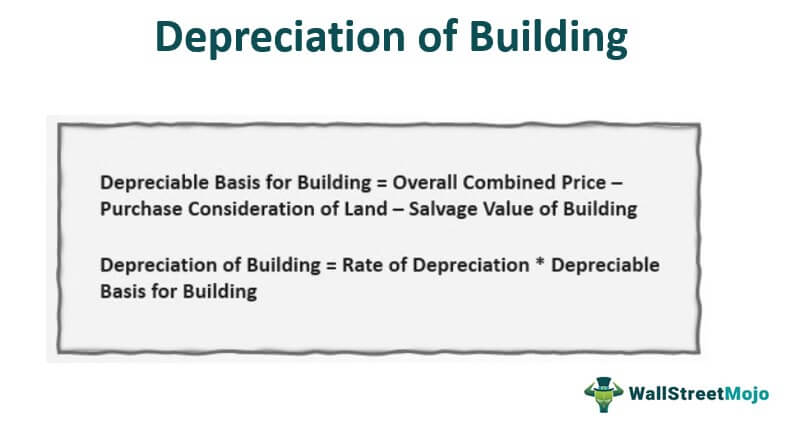

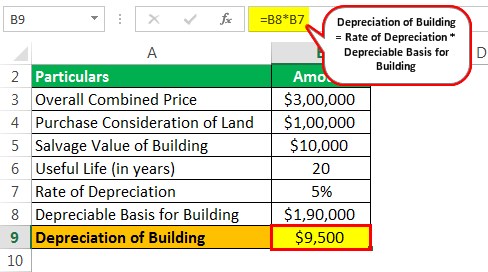

Depreciation Of Building Definition Examples How To Calculate

Inventories Office Com List Template Free Business Card Templates Business Template

Asset Lifespan How To Calculate And Extend The Useful Life Of Assets

What Is Property Building Depreciation Rate And How To Calculate It

What Is Property Building Depreciation Rate And How To Calculate It

Macrs Depreciation Calculator Table Calculator Table Guide Fixed Asset

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Of Building Definition Examples How To Calculate

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Business Valuation Veristrat Infographic Business Valuation Business Infographic